Best personal finance apps to invest in for New Year!

- jan

- 08

- Posted by Michael

- Posted in Okategoriserade

Getting your finances in order can be the key to getting your whole year in order!

Saving money is never as much fun as spending money. That's because humans are great at mortgaging the future to pay for the present. One day, though, the future will come to cash in. So, it's best be budgeted and ready when it does. Here, then, are the best iPhone apps to help you take control of your personal finances in the New Year!

Monitoring: Level Money

Information may be power, but information requires awareness. Getting a handle on your money means knowing how much money you have, all the time. That's where Level Money comes in. Hook it up to your bank account and it simply and delightfully shows you what your funds are at any given time. That way you know what you can spend... and how much you can't.

- Free - Download now

Tracking: Mint Bills & Money

Keeping track of bills can be stressful. Failing to keep track of them can be even more stressful. That's where Mint Bills & Money comes in. It will let you know when your bills are due, by email and/or push notifications, and you can pay them straight from the app. Paying via bank account is free, but there's a minor fee for paying via credit or debit (which you should really avoid).

- Free - Download now

Budgeting: BUDGT, YNAB

Once you know how much money you have, you can figure out how you want to spend it and how you want to save it. Both BUDGT—which offers an Apple Watch app—and YNAB make that simple and easy. (YNAB does require you to go all-in on its service, so keep that in mind.) You can set your budget for all the different categories you want to use, track your expenses as they come in, and see how you're doing so you can adjust as things come up.

- BUDGT - $1.99 - Download now

- YNAB - Free with subscription - Download now

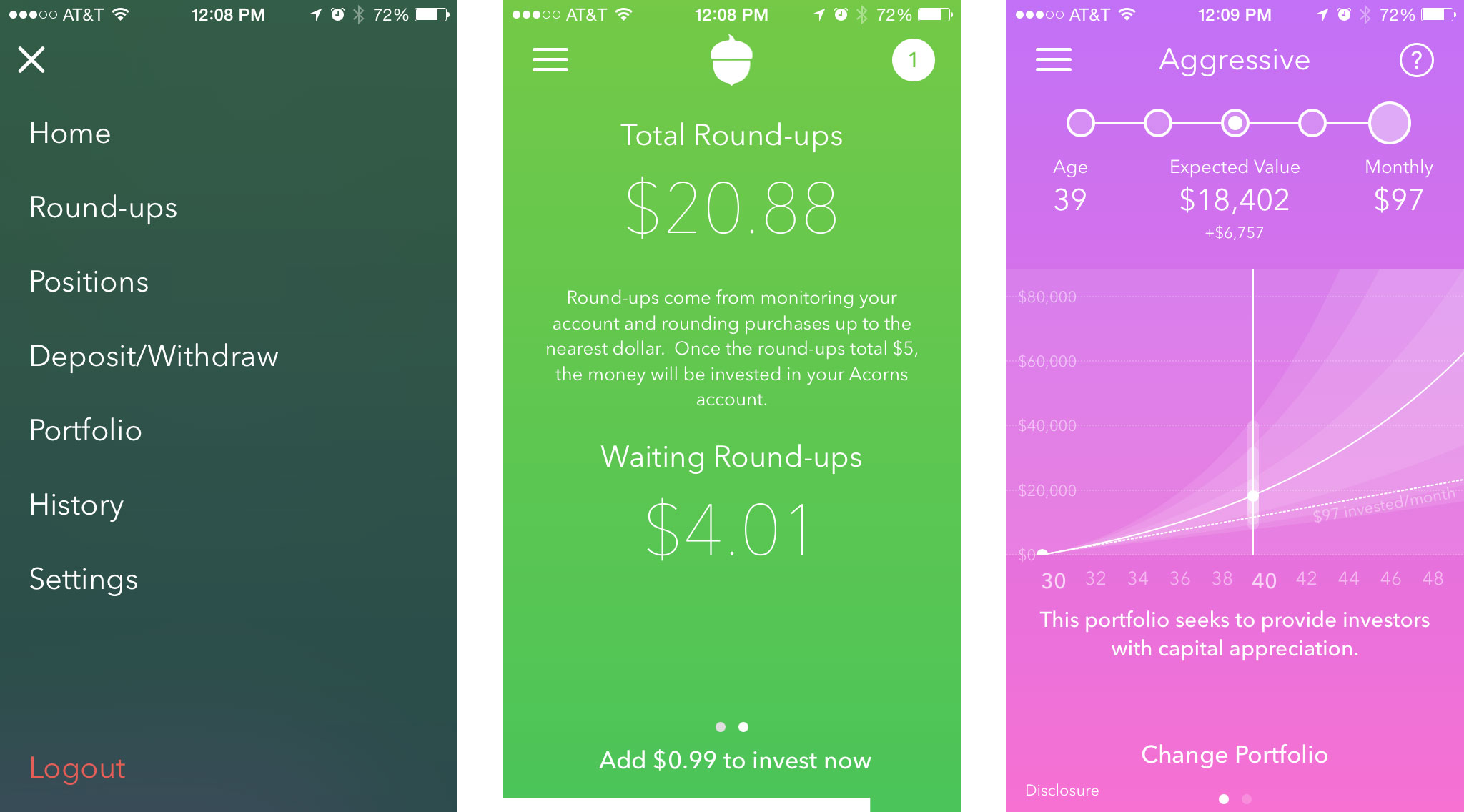

Investing: Acorns

Saving money is hard. That tempting purchase today always looks so much more gratifying than that investment payoff tomorrow. Acorns—which offers an Apple Watch app—helps with that. It lets you link your credit and debit charge and then collects all the "spare change" left over from your every day purchases, combines them together, and then invests it a professionally managed portfolio. There are six different options, and you can choose how aggressive you want to be. All for a small fee.

- Free + fee - Download now

Your bank's app

If your bank has an app and you don't use it, consider using it. Many banks now have apps, and many of those have implemented things like Touch ID to make them both secure and convenient. With your bank's app, you can check your balance, pay your bills, check on your mortgage, investments, credit cards and lines, and any and all other financial services you may be using, if they're available to you. Some even have great features like scanning and immediately depositing physical checks (because people still write those). It's a great way to just make sure everything is where it's supposed to be, and that lets you relax get on with what you're supposed to be doing.

- Search the App Store for the name of your bank

Your favorites?

Whether you've been using personal finance apps for a long time now, or are using New Year's as an excuse to get started, let me know which apps you like and why you like them!

Senaste inläggen

- Macbook Air M4-benchmark har läckt – imponerar med nästan Macbook Pro-prestanda

- Apple förbereder integration av Google Gemini i Apple Intelligence

- Windscribe VPN – snabb och effektiv vpn för Mac

- Kalifornien nominerar Steve Jobs till den amerikanska innovationsdollarn

- Kalifornien nominerar Steve Jobs till den amerikanska innovationsdollarn

Senaste kommentarer

Arkiv

- februari 2025

- januari 2025

- september 2024

- augusti 2024

- juli 2024

- juni 2024

- maj 2024

- april 2024

- mars 2024

- februari 2024

- januari 2024

- december 2023

- november 2023

- oktober 2023

- september 2023

- augusti 2023

- juli 2023

- juni 2023

- maj 2023

- april 2023

- mars 2023

- februari 2023

- januari 2023

- december 2022

- november 2022

- oktober 2022

- september 2022

- augusti 2022

- juli 2022

- juni 2022

- maj 2022

- april 2022

- mars 2022

- februari 2022

- april 2021

- mars 2021

- januari 2021

- december 2020

- november 2020

- oktober 2020

- september 2020

- augusti 2020

- juli 2020

- juni 2020

- maj 2020

- april 2020

- mars 2020

- februari 2020

- januari 2020

- december 2019

- november 2019

- oktober 2019

- september 2019

- augusti 2019

- juli 2019

- juni 2019

- maj 2019

- april 2019

- mars 2019

- februari 2019

- januari 2019

- december 2018

- november 2018

- oktober 2018

- september 2018

- augusti 2018

- juli 2018

- juni 2018

- maj 2018

- april 2018

- mars 2018

- februari 2018

- januari 2018

- december 2017

- november 2017

- oktober 2017

- september 2017

- augusti 2017

- juli 2017

- juni 2017

- maj 2017

- april 2017

- mars 2017

- februari 2017

- januari 2017

- december 2016

- november 2016

- oktober 2016

- september 2016

- augusti 2016

- juli 2016

- juni 2016

- maj 2016

- april 2016

- mars 2016

- februari 2016

- januari 2016

- december 2015

- november 2015

- oktober 2015

- september 2015

- augusti 2015

- juli 2015

- juni 2015

- maj 2015

- april 2015

- mars 2015

- februari 2015

- januari 2015

- december 2014

- november 2014

- oktober 2014

- september 2014

- augusti 2014

- juli 2014

- juni 2014

- maj 2014

- april 2014

- mars 2014

- februari 2014

- januari 2014

Kategorier

- –> Publicera på PFA löp

- (PRODUCT) RED

- 2015

- 25PP

- 2nd gen

- 32gb

- 3D Touch

- 3D-kamera

- 4k

- 64gb

- 9to5mac

- A10

- A9X

- Aaron Sorkin

- Accessories

- adapter

- AirPlay

- AirPods

- Aktiv

- Aktivitetsarmband

- Aktuellt

- Alfred

- Allmänt

- AMOLED

- Android Wear

- Angela Ahrendts

- Ångerätt

- Animal Crossing

- Animal Crossing New Horizons

- announcements

- Ansiktsigenkänning

- app

- App Store

- Appar

- Apple

- Apple Beta Software Program

- Apple Book

- Apple CarPlay

- Apple Event

- Apple iMac

- Apple Inc

- Apple Inc, Consumer Electronics, iCloud, iOS, iPhone, Mac, Mobile, Personal Software, Security Software and Services

- Apple Inc, iCloud

- Apple Inc, iOS

- Apple Inc, Mobile Apps

- Apple Inc, Monitors

- Apple Mac Mini

- Apple Macbook

- Apple MacBook Air

- Apple MacBook Pro

- Apple Macos

- Apple Maps

- Apple Music

- Apple Music Festival

- Apple Music Radio

- Apple Offer

- Apple Online Store

- Apple Park

- Apple Pay

- Apple Pencil

- Apple Podcast

- Apple Store

- Apple Store 3.3

- Apple TV

- apple tv 4

- Apple TV 4K

- Apple Watch

- Apple Watch 2

- Apple Watch 8

- Apple Watch 9

- Apple Watch Apps

- Apple Watch SE

- Apple Watch Series 2

- Apple Watch Sport

- Apple Watch Ultra

- Apple Watch, Headphones

- Apple Watch, iPhone

- AppleCare

- AppleTV

- Application

- Applications

- Apps

- AppStore

- Apptillägg

- Apptips

- AppTV

- April

- Arbetsminne

- armband

- Art Apps

- Återköp

- återvinning

- Åtgärdsalternativ

- atvflash

- Audio Apps

- Augmented REality

- Back-to-school

- Bakgrundsbilder

- BankId

- Barn

- Batteri

- batteriskal

- batteritid

- Beats

- Beats 1

- Beats Solo 2 Wireless

- Beats Solo2

- Bebis

- Beginner Tips

- Belkin

- Bendgate

- beta

- Beta 3

- betaversion

- betaversioner

- bilddagboken.se

- bilder

- bilhållare

- billboard

- Bioteknik

- Blendtec

- Bloomberg

- Bloons TD 5

- Bluelounge

- Bluetooth

- Böj

- Booking.com

- Borderlinx

- bose

- bugg

- Buggar

- Buggfixar

- Butik

- C More

- Calc 2M

- Camera

- Camera Apps

- Campus 2

- Canal Digital

- Carpool Karaoke

- Caseual

- Catalyst

- CES 2015

- Chassit

- Chip

- Chrome Remote Desktop

- Chromecast

- citrix

- clic 360

- CNBC

- Computer Accessories

- Computer Accessories, Laptop Accessories

- Connect

- Cydia

- Dagens app

- Dagens tips

- Damm

- Danny Boyle

- Data

- datamängd

- Datorer

- Datortillbehör

- Datum

- Defense

- Dekaler

- Designed by Apple in California

- Developer

- Development

- Digital Inn

- Digital Touch

- Digitalbox

- DigiTimes

- Direkt

- Discover

- display

- DisplayMate

- Dive

- Docka

- Dräger 3000

- Dropbox

- Droples

- DxOMark

- E-post

- earpod

- EarPods

- Earth Day

- Eddie Cue

- eddy cue

- Educational Apps

- Ekonomi

- Ekonomi/Bransch

- El Capitan

- Elements

- ElevationLab

- Elgato Eve

- Elgato Eve Energy

- EM 2016

- Emoji

- emojis

- emoticons

- Enligt

- Entertainment Apps

- EU

- event

- Eventrykten

- EverythingApplePro

- Faceshift

- facetime

- Fäste

- Featured

- Features

- Feng

- Film / Tv-serier

- Filmer

- Filstorlek

- Finance Apps

- Finder For AirPods

- Finland

- FireCore

- Fitbit

- Fitness Accessories

- Fjärrstyr

- Flurry

- Födelsedag

- fodral

- Förboka

- Force Touch

- förhandsboka

- Första intryck

- Forumtipset

- foto

- FoU (Forskning och Utveckling)

- Fource Touch

- Foxconn

- FPS Games

- Framtid

- Fre Power

- Frontpage

- Fullt

- Funktioner

- Fuse Chicken

- Fyra

- Gadgets

- Gagatsvart

- Gamereactor

- Games

- Gaming

- Gaming Chairs

- Gästkrönika

- General

- Gigaset

- Gitarr

- Glas

- GM

- Google Maps

- Google Now

- gratis

- grattis

- Guide

- Guider

- Guider & listor

- Guld

- hack

- Halebop

- hållare

- Hälsa

- Hårdvara

- HBO

- HBO Nordic

- Health

- Health and Fitness

- Health and Fitness Apps

- Hej Siri

- Helvetica Neue

- Hemelektronik

- Hemknapp

- Hemlarm

- Hermes

- Hitta min iphone

- Hjärta

- högtalare

- HomeKit

- HomePod

- Homepod Mini

- hörlurar

- htc

- Hue

- Humor

- i

- I Am A Witness

- IBM

- iBolt

- iBomber

- iBook

- icar

- iCloud

- iCloud Drive

- iCloud Voicemail

- iCloud.com

- iDevices

- IDG Play

- idownloadblog

- iFixit

- ikea

- iKörkort

- iLife

- Illusion Labs

- iMac

- IMAP

- iMessage

- iMessages

- iMore Show

- Incipio

- InFuse

- Inspelning

- Instagram-flöde

- Instrument

- Intel

- Internet/Webbtjänster

- iOS

- iOS 10

- iOS 12

- iOS 17

- iOS 18

- iOS 5

- iOS 7

- iOS 8

- iOS 8 beta

- iOS 8.1.3

- iOS 8.2

- iOS 8.3

- iOS 8.4

- iOS 8.4.1

- iOS 9

- iOS 9 beta 4

- iOS 9.1

- iOS 9.1 beta 2

- iOS 9.2

- iOS 9.2.1

- iOS 9.3

- IOS Games

- ios uppdatering

- iOS, iPad, MacOS

- iOS, iPhone

- ios9

- iPad

- iPad Accessories

- iPad Air

- iPad Air 2

- iPad Air 3

- iPad Air 5

- iPad Apps

- iPad Mini

- iPad mini 4

- iPad Mini 6

- iPad mini retina

- iPad Pro

- iPad, iPhone, Mac

- iPad, iPhone, Mobile Apps

- iPad, iPhone, Streaming Media

- iPados

- iphone

- iPhone 12

- iPhone 14

- iPhone 14 Pro

- iPhone 15

- iPhone 16

- iPhone 17

- iPhone 5

- iPhone 5S

- iPhone 5se

- iPhone 6

- iphone 6 plus

- iPhone 6c

- iPhone 6s

- iPhone 6S plus

- iPhone 7

- iPhone 7 display

- iPhone 7 Plus

- iPhone 7s

- iPhone Accessories

- iPhone Apps

- iPhone Cases

- iPhone SE

- iphone x

- iPhone XS

- iPhone XS Max

- iPhone, Mobile Apps

- iPhone7

- iPhoneGuiden

- iPhoneguiden.se

- iPhones

- iPod

- iPod Nano

- iPod shuffle

- ipod touch

- iSight

- iTunes

- iWatch

- iWork

- iWork för iCloud beta

- Jailbreak

- James Corden

- Jämförande test

- Jämförelse

- Jet Black

- Jet White

- Jönssonligan

- Jony Ive

- Juice Pack

- Juridik

- Just mobile

- kalender

- kalkylator

- Kamera

- Kameratest

- Karriär/Utbildning

- Kartor

- Kevin Hart

- keynote

- Keynote 2016

- KGI

- KGI Security

- Kina

- Klassiskt läderspänne

- Kod

- Kollage

- koncept

- konceptbilder

- köpguide

- krasch

- Krascha iPhone

- Krönika

- Kvartalsrapport

- Laddhållare

- laddningsdocka

- Laddunderlägg

- läderloop

- lagar

- Lagring

- Lajka

- Länder

- lansering

- laserfokus

- Layout

- leather loop

- LG

- Liam

- Lifeproof

- Lightnigport

- lightning

- Linux

- LinX

- live

- Live GIF

- Live Photos

- Live-event

- Livsstil

- Ljud & Bild

- Logitech

- LOL

- Lösenkod

- Lösenkodlås

- Lovande spel

- LTE

- Luxe Edition

- M3

- M3TV

- Mac

- Mac App Store

- Mac Apps

- Mac Mini

- Mac OS

- Mac OS X

- Mac OS X (generellt)

- Mac OS X Snow Leopard

- Mac Pro

- Mac, MacOS

- Mac, Online Services

- Mac, Security Software and Services

- Macbook

- Macbook Air

- Macbook Pro

- MacBook, MacOS

- Macforum

- Macintosh

- macOS

- MacOS, Security Software and Services

- Macs

- MacWorld

- Made for Apple Watch

- magi

- Magic

- MagSafe

- Martin Hajek

- matematik

- Meddelanden

- Media Markt

- Medieproduktion

- Mediocre

- Messaging Apps

- Messenger

- MetaWatch

- Mfi

- Michael Fassbender

- microsoft

- Mikrofon

- Minecraft

- Ming-Chi Kuo

- miniräknare

- minne

- Mixer

- Mixning

- Mjukvara

- mobbning

- Mobile Apps

- Mobile Content

- Mobilt

- Mobilt/Handdator/Laptop

- Mobiltelefon

- Mockup

- Mophie

- mors dag

- moto 360

- Motor

- MTV VMA

- multitasking

- Music

- Music Apps

- Music, Movies and TV

- Musik

- Musikmemon

- MW Expo 2008

- native union

- Nätverk

- Navigation Apps

- nedgradera

- Netatmo Welcome

- Netflix

- Netgear Arlo

- News

- Niantic

- Nike

- Nikkei

- Nintendo

- Nintendo Switch

- Nöje

- Norge

- Notis

- Notiscenter

- nya färger

- Nyfödd

- Nyheter

- Officeprogram

- Okategoriserade

- OLED

- omdöme

- Omsättning

- OS X

- OS X El Capitan

- OS X Mavericks

- OS X Yosemite

- Outlook

- Övrig mjukvara

- Övrigt

- PanGu

- papper

- patent

- PC

- pebble

- Pebble Smartwatch

- Pebble Steel

- Pebble Time

- Pebble Time Steel

- Persondatorer

- Petter Hegevall

- PewDiePie

- Philips

- Philips Hue

- Phones

- Photoshop

- Planet of the apps

- Plex

- Pluggar

- Plus

- Plusbox

- Podcast

- Podcast Apps

- Pokemon

- Pokemon Go

- Policy

- Porträttläge

- PP

- Pris

- priser

- problem

- Problems

- Productivity Apps

- Program

- Prylar & tillbehör

- Publik

- publik beta

- QuickTime

- räkenskapsår

- räkna

- ram

- RAM-minne

- Rapport/Undersökning/Trend

- Rea

- Reading Apps

- recension

- Red

- reklaamfilm

- reklam

- reklamfilm

- reklamfilmer

- rekord

- Rendering

- reparation

- Reportage

- Reptest

- ResearchKit

- Retro

- Review

- Ring

- Ringa

- Rocket Cars

- Rosa

- Rumors

- Rumours

- RunKeeper

- rykte

- Rykten

- Safir

- Säkerhet

- Säkerhetsbrist

- Samhälle/Politik

- samsung

- Samtal

- San Francisco

- SAP

- security

- Series 2

- Servrar

- Shigeru Miyamoto

- Sia

- Simulation Games

- Siri

- SJ Min resa

- skal

- Skal iPhone 6

- skal iPhone 6s

- skärm

- SKärmdump

- Skärmglas

- Skribent

- skribenter medarbetare

- Skriva ut

- skruvmejsel

- skydd

- Skyddsfilm

- Skype

- slice intelligence

- Smart

- smart hem

- Smart Home

- Smart Keyboard

- Smart klocka

- Smart Lights

- smartphone

- Smartwatch

- SMS

- Snabbt

- Snapchat

- Social Apps

- Software

- Solo2

- sommar

- Sonos

- Sony

- soundtouch

- Space Marshals

- spår

- Speakers

- Special Event

- Spel

- Spelkonsol

- Spellistor

- Split Screen

- Split View

- Sport

- Sportband

- Sports Apps

- spotify

- Spring forward

- Statistik

- Steve Jobs

- Stickers

- Stockholm

- Stor iPhone

- Storlek

- Story Mode

- Strategy Games

- streama

- Streaming

- Streaming Devices

- Streaming Media

- stresstest

- Ström

- Studentrabatt

- stylus

- Super Mario Run

- support

- Surf

- Surfplatta

- svenska

- sverige

- Sverigelansering

- Switch

- Systemstatus

- Systemutveckling

- tåg

- Taig

- Tangentbord

- Taptic Engine

- Tårta

- tät

- Tävling

- Taylor Swift

- Teknik

- tele 2

- Telefoner

- Telekom

- Telia

- Test

- Tid

- TikTok

- Tile

- tillbehör

- Tim Cook

- TIME

- TimeStand

- Tiny Umbrella

- Tips

- Toppnyhet IDG.se

- Touch ID

- TouchID

- tower defence

- trådlös laddning

- Trådlösa hörlurar

- trådlöst

- trailer

- Travel Apps

- Tre

- TrendForce

- TripAdvisor

- Trolleri

- trump

- TSMC

- Tum

- tv

- TV Apps

- tvätta

- tvOS

- tvOS 9.2

- tvOS beta 2

- Tweak

- Typsnitt

- Ubytesprogram

- UE MegaBoom

- Unboxing

- Underhållning/Spel

- unidays

- United Daily News

- Unix

- Updates

- Uppdatera

- uppdatering

- Upplösning

- upptäckt

- USA

- Ut på Twitter

- utbyte

- utbytesprogram

- Utilities Apps

- Utlottning

- utrymme

- utvecklare

- varumärke

- Vatten

- Vattentålig

- vattentät

- vävt nylon

- Verktyg

- Viaplay

- Vibrator

- video

- Videoartiklar och webb-tv (M3/TW/CS)

- Villkor

- viloknapp

- Virtual Reality

- Virus

- visa

- Vision Pro

- VLC

- Volvo on call

- VPN

- W1

- Waitrose

- Watch OS

- WatchOS

- WatchOS 2

- watchOS 2.0.1

- watchOS 2.2

- Webbtv (AppTV)

- wi-fi

- Wifi-samtal

- Windows

- Windows 8

- WWDC

- WWDC2015

- yalu

- Youtube

- Zlatan